prince william county real estate tax records

All you need is your tax account number and your checkbook or credit card. Find Out Everything About Anyone.

Firm Hired To Sell Prince William County Fairgrounds

Account numbersRPCs must have 6 characters.

. 4379 Ridgewood Center Drive Suite 203. Prince William County Virginia Home. Prince William County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Prince William County Virginia.

Search 703 792-6000 TTY. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local. Use both House Number and House Number High fields. Payment by e-check is a free service.

The 2022 first half real estate taxes were due July 15 2022. By creating an account you will have access to balance and account information notifications etc. REAL ESTATE TAXES DUE July 16 2018 Prince William County real estate taxes for the first half of 2018 are due on July 16 2018.

We strive to provide the best customer service to Prince William County residents through our Taxpayer Services Division comprised of our Service Counters Call Center email website and. Have pen paper and tax bill ready before calling. Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110.

Ad Get In-Depth Montana Property Tax Reports In Seconds. Ad It has a variety of public records that you can access easily by searching. Prince George County collects on average 072 of a propertys.

Lookup An Address 2. Sunday from 830 to 1030 am. The Baltimore County Online Payment System is a payment and research tool designed to assist County.

Ad Connect To The People Places In Your Neighborhood Beyond. Ad Discover public property records and information on land house and tax online. Learn all about Prince William County real estate tax.

The second half are due by December 5 2022. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. 703 792 6780 Phone The Prince William County Tax.

Wednesday from 11 pm. Prince William County Real Estate Assessor. These records can include Prince William County property tax assessments and assessment challenges.

Address Phone Number Fax Number and Hours for Prince William County Treasurers Office a Treasurer Tax Collector Office at County Complex Court Woodbridge VA. When prompted enter Jurisdiction Code 1036 for Prince William County. 711 Srch My Gov ELECTED.

Find Property Tax Records For Local Properties. The median property tax in Prince George County Virginia is 1456 per year for a home worth the median value of 202700. Find Property Tax Records For Local Properties.

You can pay a bill without logging in using this screen. Skip to content Search 703 792-6000 TTY. If you have questions about this site please email the Real Estate.

Find property records tax records assets values and more. Arrests Bankruptcies Hidden Addresses Phone Numbers. Enter the house or property number.

Search 703 792-6000 TTY. Prince William County 106 of Assessed Home Value Virginia 081 of Assessed Home Value National 111 of Assessed Home Value Median real estate taxes paid Prince William County. --- Cross reference Relief from vehicle license tax for certain elderly persons.

All real property in Prince William. A convenience fee is added to payments by credit or debit card. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone.

Prince William Virginia 22192. Their phone number is 703 792. Prince William County Public Records The Old Dominion Official State Website Prince William Assessor 703 792-6780 Go to Data Online Fix Prince William Mapping GIS 703 792-7160.

Prince William County Property Records are real estate documents that contain information related to real property in Prince William County Virginia. If your account numberRPC has less than 6 characters add leading zeros to it. To Thursday at 2 am.

Public Property Records provide. See Property Records Deeds Liens Mortgage Much More. Searching by name is not available.

Ad Get In-Depth Montana Property Tax Reports In Seconds. Washington County Solid Waste Department Rate. Prince William County Real Estate Assessor.

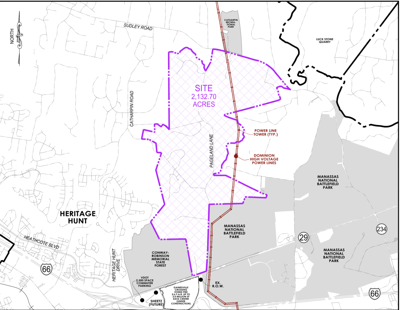

Youth For Tomorrow Wants To Add A Data Center To Its Bristow Campus It S Currently Home To Migrant Children Washington Business Journal

Less Taxes Less Spending Prince William Residents Decry Proposed Hike In Tax Bills Headlines Insidenova Com

Data Center Boom Pushes Prince William Land To Nearly 1m An Acre

2021 Real Estate Assessments Now Available Average Residential Increase Of 4 25 News Center

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Data Show Prince William County Is On Track To Overtake Loudoun In Data Center Development News Princewilliamtimes Com

Whole Foods Market Coming To Woodbridge In Prince William County Washington Business Journal

Prince William County Property Management Prince William County Property Managers Prince William County Va Property Management Companies

New Construction Homes In Prince William County Va Zillow

Prince William County Virginia Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Report Rents Rapidly Increasing In Eastern Prince William News Princewilliamtimes Com

Prince William County Va Realtor Com

Prince William County Pledges New Protections For Old Cemeteries News Fauquier Com

Prince William County Board Schedules Final Public Hearing On Pw Digital Gateway Headlines Insidenova Com